Contents

A contract of Marine Insurance shall not be submitted in evidence unless it is embodied in a Marine Policy accordance with Marine Insurance Act. The policy may be executed and issued either at the time when the contract is concluded or afterwards.

Dictionary Meaning of ” POLICY ” : A set of ideas or a plan of what to do in particular situations that has been agreed to officially by a group of people, a business organization, a government, or a political party.

Before proceeding further, please go through an example below:

A Marine Policy must specify the following:

- Name of the assured or the person who effects the insurance on his behalf;

- Subject matter insured and the risks insured against;

- Voyage or period of time or both;

- Amount insured;

- Names of the insurer(s);

- Signature of the insurer.

A marine policy must be signed by or on behalf of the insurer.

Types of Marine Policy

1. Voyage Policy

When the contract is to insure the subject matter at and from or from one place to another, it is called Voyage Policy.

2. Time Policy

When the contract is to insure the subject matter for a definite period of time, it is called Time Policy. A time policy can be made for a maximum period of 12 months. A contract for both time and voyage may be included in the same policy.

3. Valued Policy

A Valued Policy is the one which specifies an agreed value of the subject-matter insured. The value fixed by the policy is as between the insurer and assured, conclusive of the insurable value of the subject matter intended to be insured irrespective of whether the loss is total or partial.

4. Unvalued Policy

An unvalued policy is the one which does not specify the value of the subject-matter insured. The insurable value of the subject matter is to be subsequently ascertained in the manner as mentioned in the insurance policy.

5. Floating Policy (Cargo Insurance)

It describes the insurance in general terms and leaves the names of the ships and other particulars to be defined by a subsequent declaration. The subsequent declaration may be made by an endorsement on the policy.

Deviation

A deviation occurs where the vessel leaves the stated or customary course of the voyage with the intention of returning to that course and completing the voyage.

Effects of Deviation on Marine Policy

The liability of the insurer ceases immediately after the deviation occurs. Where a ship without lawful excuse deviates from the voyage contemplated by the policy, the insurer is discharged from the liability as from the time of deviation and it is immaterial that the ship may have regained her route before any loss occurs.

When is deviation excused as per Marine Insurance Act?

- When authorised by any special term in the policy or,

- When caused by circumstances beyond the control of the Master and employer or,

- Where reasonably necessary for complying with expressed or implied warranty or,

- When reasonably necessary for the safety of the ship or subject-matter insured or,

- For the purpose of saving human life or aiding a ship in distress where human life is in danger or,

- When reasonably necessary for all the purpose of obtaining medical or surgical aid for any person on board the ship or,

- Where caused by the Barratrous Act of the Master or crew, if barratry is one of the perils insured against.

When the cause of exercising the deviation ceases to operate, the ship must resume her course.

Insured Perils in a Marine Hull & Machinery Policy

- Perils of the sea, river, lakes and other navigable waters

- Fire Explosion

- Violent theft by a person outside the vessel

- Jettison

- Piracy

- Breakdown of or accident to nuclear installation or reactors

- Contact with aircraft or similar flying objects falling from the land conveyance, dock or harbour equipment or installation

- Earthquake, volcanic eruption or lightning

Additional Perils

- Accident in loading, discharging or shifting cargo or fuel

- Bursting of boilers, breakage of the shaft or any latent defect in Hull and Machinery (H&M)

- Negligence of Master, crew, officers or pilots

- Negligence of Charterer

- Negligence of Repairer

- Barratry by Master, officers or Crew.

Other Clauses in Marine Policy

Pollution Hazard Clause

It covers loss or damage to the vessel caused by any governmental authority acting under the powers vested in it to prevent or mitigate a pollution hazard or threat.

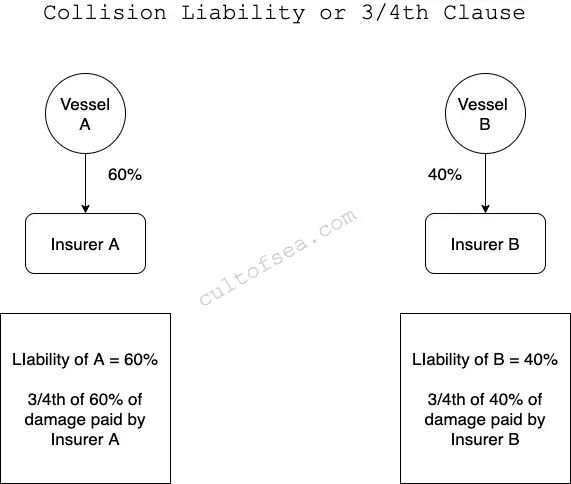

Collision Liability or 3/4th clause

Underwriters agree to indemnify the Assured for three-fourths of any sum or sums paid by the Assured to any other person or persons by reason of the Assured becoming legally liable by way of damages for:

- loss of or damage to any other vessel or property on any other vessel

- delay to or loss of use of any such other vessel or property thereon

- the general average of, salvage of, or salvage under contract of, any such other vessel or property thereon,

where such payment by the Assured is in consequence of the Vessel hereby insured coming into collision with any other vessel.

The remaining 1/4th of the liability is covered by the P&I club. This is called the 1/4th or 4/4th liability clause.

Exclusions in a Marine Hull Policy

- War, Civil War, Revolution

- Capture and Seizure arrest, restraint

- Derelict mines, torpedos or weapons of war

- Strikes

- Malicious Acts

- Nuclear Explosions

- Negligence of the assured

- Breach of Warranty

- Wrongful Disclosure

Leave a Reply