Contents

Purpose of Marine Insurance

Marine Insurance is an agreement whereby the insurer indemnified the assured in manner and extent provided, against losses incidental to marine adventure.

- Spreading of Risk – If a loss occurs, the insured will be put back into the same financial position as just before the loss. The insured must not profit from the loss.

- Aid to Security – This removes the uncertainty of a potential financial loss. Individuals and businesses are freer to expand without the need to set aside for reserves for the future.

- Aid to Credit – Loans are not advanced unless the item being financed is insured i.e. insurance protects creditors investment.

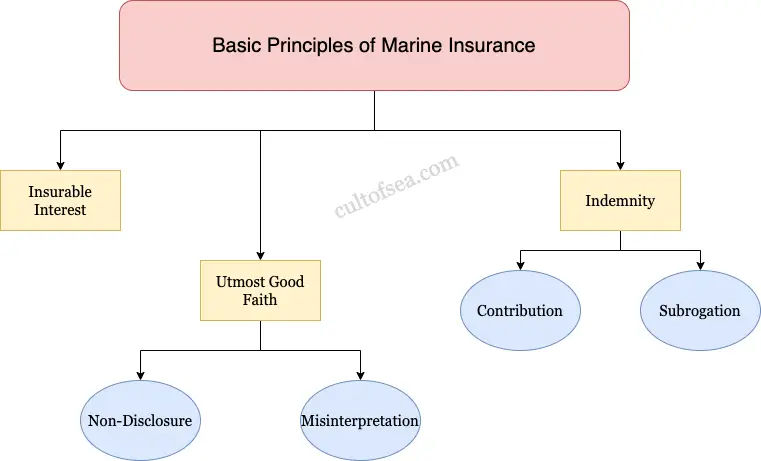

Basic Principles of Marine Insurance

1. Insurable Interest

- The insured must have financial interest in the object of insurance.

- The subject matter insured must be a physical object exposed to peril.

- The insured must have some legal relationship to the subject matter insured and must stand to benefit by its preservation or lose by its loss or damage.

- Without the rule of Insurable Interest, a person could insure a vessel with the hope it would sink and collect the insurance which is called wagering or gaming.

2. Utmost Good Faith

A contract of marine insurance is based upon utmost food faith and if utmost good faith not be observed by either party, the contract may be voidable by the other party. It is required by both parties. It can be classified as follows:

(a) Non Disclosure

Failure to inform the insurer of a material fact leads to non-disclosure. Every circumstance which would influence the insurer’s judgement in fixing the premium or determining whether or not to accept the risk would be material.

It includes failure on the insurer’s part to find out all material facts of the risk and also by any change in the material circumstances during the period of insurance to be communicated to the insurer.

(b) Misinterpretation

This is an incorrect statement about a material fact. The following circumstances need not be disclosed:-

- Any Circumstance which diminishes the risk.

- Any circumstance which is known or presumed to be known to the insurer in the ordinary course of the business. Eg. general nature of cargo, method of loading, log carrier is likely to get more damage by the cargo than a bulk carrier.

3. Indemnity

As per the Marine Insurance Act, a contract of marine insurance is a contract where the insurer undertakes to indemnify the assured in the manner and to the extent thereby agreed against marine loss.

To indemnify is to make good the losses suffered not by replacement but by financial payment. The amount to which the insured is entitled is known as the measure of indemnity and depends on the type of loss – Total or Partial and the basis of valuation in the policy.

There are two subprinciples of indemnity:-

(a) Contribution

The assured cannot claim more than once on the same risk thus if the assured has policies covering the same risk with 2 insurers (double insurance) then each makes a pro-rata contribution in the settlement.

(b) Subrogation

As per this principle, the assured cannot recoup his loss from another party after the insurer has settled his claim.

For Eg. When the insurer has paid a cargo owner’s claim, the cargo owner cannot afterwards claim from the carrier. Instead, the insurer who paid the claims subrogates or takes over the assured’s rights in respect of any claim against the third party.

Also, have a look at Doctrine of Proximate Clause.

Warranties

Warranty is a promise by the insured that a specified state of affairs or conditions will continue to exist for the duration of the policy. A warranty may be Expressed or Implied Warranty.

Expressed Warranty

An expressed warranty can be in any form of words, and must be included in or written upon the policy or must be contained in some document incorporated by reference into the policy.

Implied Warranty

The law regards certain conditions as implied part of the insurance contract, although they may not be specifically stated. In marine insurance, implied warranties are:-

- Warranty of Legality – The venture must be legal to the extent that the insured is in a position to control it.

- Warranty of Seaworthiness – The vessel must be seaworthy at the commencement of the voyage.

Types of Marine Insurance Covers Required

A shipowner or a ship manager acting on behalf of a shipowner may require the following insurance covers against:

- actual or total loss of his ship’s hull, machinery and equipment (H & M cover);

- accidental (particular average) damage to his ship’s hull, machinery and equipment (H& M cover);

- liability to owners of other vessels (and their cargoes) with which the ship collides(collision liability);

- liabilities for general average charges;

- liabilities for damage done by his ship to a third party’s properties;

- liabilities for other third party risks, e.g. cargo claims, personal injuries, pollution, wreck removal costs, etc. (called P & I risks);

- liabilities for oil pollution claims;

- loss of earnings due to strikes;

- loss of earnings due to the operation of war risks;

- loss of freight;

- loss of charter hire (e.g. When a vessel goes “off-hire” after sustaining damage);

- increased value, disbursements and excess liabilities (an additional source of recovery over and above the hull and machinery insured value in case of a total loss); and employer’s liabilities to workers.

Shipowners may need additional special insurance when the vessel is deviated from the intended course e.g. ” shipowners’ liability insurance (SOL)” if he loses his defences to liabilities under The Hague or Hague-Visby Rules. There are no statutory requirements for ships or cargo to be insured, but if they are not insured they need to be self-insured. IMO guidelines on Shipowners responsibilities in respect of Maritime Claims recommends Shipowners to place on board the Certificate of Entry of the P & I Club.

What kind of insurance covers are there for Time and Voyage Charterers?

The normal insurance covers for Time and Voyage Charterers are:

- legal costs and expenses arising out of disputes related to hiring, freight, dead freight and passage money, general and particular average, demurrage or despatch, detention, breach of the charter party, bill of lading etc., the proper loading etc. of cargo, quality of bunkers supplied;

- loss of or damage to the vessel;

- loss of or damage to cargo;

- oil pollution other than that arising from a tanker in US territorial waters;

- loss of or damage to third party property;

- death or personal injury claims;

- fines;

- damage to fixed property (e.g. wharf or dock); wreck clearance costs;

- the proportion of general average or salvage charges not covered by any other insurance;

- liability arising out of breach of or deviation under a bill of lading (e.g. cargo earned on deck against underdeck bill of lading);

- physical loss of charterers bunkers;

- loss of freight at risk;

- oil pollution arising from a tanker in US territorial waters; and

- stowaway costs.

General Average

A general contribution of money paid by all parties concerned in a marine adventure in direct proportion to their several interests when a voluntary or deliberate sacrifice has been made of one or more of the party’s goods in time of peril with a view to saving the remainder of the property. Read more

Elements

- there must be a sacrifice or expenditure;

- the sacrifice or expenditure must be extraordinary;

- the sacrifice or expenditure must be intentionally made or incurred;

- the sacrifice or expenditure must be reasonably made or incurred;

- the sacrifice or expenditure must be made for the common safety;

- the sacrifice or expenditure must be made for the purpose of preserving the property from peril.

Examples of sacrifices that may be allowed in a general average are:

- cargo jettisoned to refloat a grounded vessel or to prevent the capsizing of a dangerously listed vessel;

- machinery damage sustained during refloating operations.

Examples of expenditures that may be allowed in a general average are:

- costs of salvage expenditure including salver’s reward;

- costs of entering a port, staying in and leaving a port of refuge;

- costs of cargo discharge or any other operations including dry docking etc.

What do you understand by sacrifices Extraordinarily, Intentionally and Reasonably made?

- Extraordinary nature of sacrifice and expenditure is not an ordinary or everyday loss or expense incurred in running a ship and carrying cargoes. Loss of anchor to prevent grounding is not extraordinary, whereas losing an anchor laid out as ground tackle during a refloating operation may be allowed. Similarly, damage to the engine due overworking in trying to prevent grounding is not extraordinary, whereas damage to the engine during a refloating operation may be allowed. A wide variety of costs, however, small including extra taxi fares for superintendents can be recovered in general average expenditure.

- Intentionally made expenditure are those of C02 cylinders discharged to put off a fire onboard or wetting damage was done due to flooding of a hold. The cost of damage done by the fire itself is not covered under the general average act. Beaching a leaking ship to prevent sinking is intentional and covered by the general average. The cost of refloating an accidentally grounded ship is intentional and allowed.

- Reasonable expenditure can be that of the amount of cargo required to be jettisoned. Excess cargo jettisoned is not reasonable and may not be allowed under the general average. Similarly, expenditure in a port of refuge over and above reasonable costs may not be allowed.

What is General Average Loss under marine insurance?

The principle of general average can be said as that which has been sacrificed for the benefit of all shall be made good by the contribution of all.

The objective of general average is to ensure that the owner of the ship or cargo who has incurred expenditure or suffered a sacrifice of his property in order to save the vessel or the cargo from a perilous position receives a contribution to his loss from all those who have benefited from the action.

The general average loss is a partial loss incurred through a deliberate act performed with the intention of preserving all the property involved in a voyage from a danger which threatens them all. General average losses are equitably shared by all the parties to the ” common maritime adventure “, each party contributing in proportion to his share of the total values involved. In theory, therefore, any expense, no matter how small, by a shipowner resulting in saving the ship or cargo on board can be a general average act.

However, in practice, the general average is not declared every time since it involves lots of calculations, contributions, collection and a huge amount of time, effort and expense.

What constitutes Common Maritime Adventure?

A common maritime adventure is a voyage where several parties have some financial interest, as opposed to ballast voyage of a non-chartered liner vessel, where the only party involved is the shipowner. The parties to the common maritime adventure could include:

- the shipowner;

- each consignee of cargo;

- if the ship on time charter, owner of bunkers on board;

- the recipient of freight (shipowner or time charterers);

- the owner of any equipment on hire e.g. welding machine or diving equipment etc.

What documents and information are required to make a claim?

- deck and engine room log books covering the casualty and repair period;

- Master’s and/or Chief engineer’s detailed report as appropriate;

- relevant letter of protest;

- underwriter’s surveyor’s report;

- class surveyor’s report;

- owner’s superintendent’s report;

- receipted accounts for repair and/or any spare parts supplied by owners, in connection with repairs duly endorsed by underwriter’s surveyor as being fair and reasonable;

- accounts covering any dry-docking and general expenses relating to the repairs endorsed as above;

- port disbursements;

- fuel and engine room spares consumed together with the cost of replacements;

- accounts for owners’ repairs effected concurrently with damage repairs copies of faxes, email and telexes sent and details of long-distance calls made in connection with the casualty together with their costs;

- any accounts rendered by surveyors etc., with dates of payment where made

There are similar documents and information required for repairs and after a collision. In the case of collision, steps taken to establish liabilities for the collision and eventual settlement in the apportionment of blame including the copy of the claim for attempted recovery. Efforts to limit liabilities and costs thereof are taken into consideration.

I would like yuou to publish a few paragraphs on ” risk of collision”. what is the procedure?

Glat to hear that Capt. Rao, please email to cultofsea@outlook.com and If it’s a full article, you shall be added as an author.