Documentary Credit System is a payment system used in international trade where the BUYER and SELLER are from different countries. It is developed to include a measure of security to trade transactions by involving a third party, the BANK.

The bank provides additional security for both parties i.e. it plays the role of an intermediary by assuring the seller that he will be paid if he provides the bank with the required documents and by assuring the buyer that his money will not be paid unless the shipping documents evidencing proper shipment of his goods are presented.

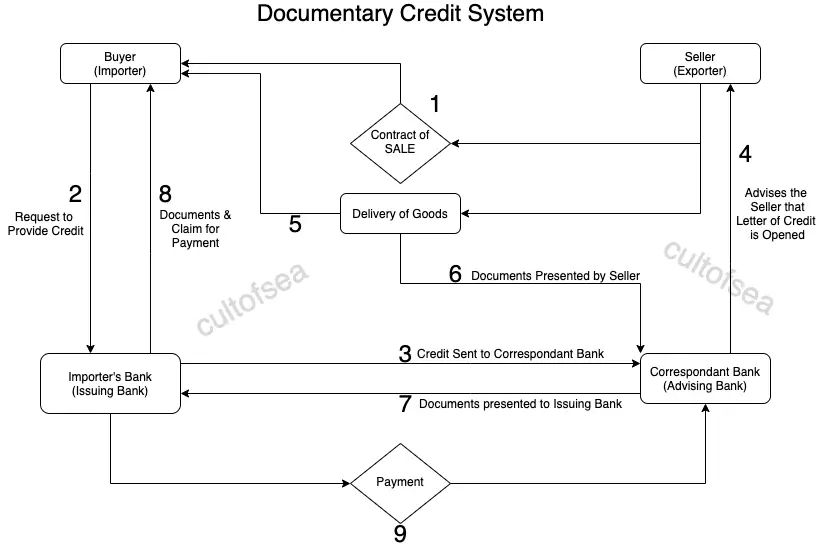

How Documentary Credit System Works?

Assuming the underlying transaction is one of sale:

- The Seller and the overseas buyer agree in a Contract of sale that payment shall be made under a Documentary Credit.

- The buyer requests a Bank in his own country to open a documentary credit in favour of the seller on the time specified by the buyer.

- The Issuing Bank opens credit in favour of the beneficiary if the specified documents are duly tendered and other times & conditions of the credit are followed. The issuing bank may open the credit by sending it directly to the seller or the issuing bank may arrange for a bank in the seller’s country – A Correspondent Bank.

- The Correspondent Bank advises the seller that the credit has been opened and the seller may go ahead and ship the items.

- The seller ships the goods and tenders the required documents to the correspondent bank. The documents usually include an invoice, insurance certificate, full set of “clean on board” bills of lading made “to order” which are obtained once goods are shipped.

- The documents submitted to the Correspondent ( Advising ) bank shall conform to the terms of the credit by the seller. The Advising Bank will pay the contract price and reimbursements to the Seller.

- Documents submitted by the seller to the Advising Bank are presented to the Issuing bank.

- Before releasing the documents to the buyer, the issuing bank will, in turn, seek payment from the buyer.

- Buyer receives documents, enabling him to obtain the release of goods from the ship and the Issuing Bank reimburses the Seller Bank.

Letter of Credit

Letter of credit is a letter from Bank guaranteeing that a buyer’s payment to a seller will be released on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the fall or for the remaining amount of purchase.

Advantages of Documentary Credit in a Direct Sale:

- It enables the buyer to confirm his paying capacity which is important when establishing new trade relations.

- By guaranteeing the payment with a documentary credit, the buyer can achieve more profitable terms of delivery and payment for goods.

- The buyer can be sure that the bank will pay money to the seller no sooner than it receives the documents corresponding to the delivery of the goods.

- In case the documents submitted by the seller do not correspond to the terms of the Letter of Credit (quality, quantity, packing etc. not in compliance) the buyer can be sure that the payment under the letter of credit will not be processed.

- Banking experience and knowledge for the implementation of complex commercial contracts can be applied.

- The documentary credit is a payment obligation of the bank and the seller can be sure of receiving the money subject to the timely submission of the documents corresponding to the terms of the letter of credit to the bank.

- Chances of complexities with the documents and fraud are less, a number of parties to the contact are limited and they are well connected to each other through a single contract of sale. Grievances if any can be resolved in a court of law effortlessly.

Please also post disadvantages of documentary credit system.Very well explained dcs.